LAST UPDATED 08/15/19

www.alphonsemourad.com

www.uscorruptjudges.com

www.bostonmandelascandal.com

ALL LEGAL DOCUMENTS PERTAINING FOR THIS CASE ARE ON PUBLIC RECORD AT THE BOSTON FEDERAL COURT HOUSE AND THE INTERNET WORLD WIDE.

Website is updated daily please check back periodically.

Judge Torruella, Circuit Judge; Judge Lynch, Circuit Judge; and Judge Coffin, Senior Circuit Judge

Press Release

12/4/05

Contact Alphonse Mourad:

Voice: 617-458-1835

EMail: Mouradprotest@gmail.com

Alphonse Mourad files his latest Motion (on November 14, 2005) to reopen his case against the Commissioner of Internal Revenue based on fraudulent statements made by the IRS attorney before the three Appellate Court Judges (Judge Torruella, Circuit Judge; Judge Lynch, Circuit Judge; and Judge Coffin, Senior Circuit Judge).

INDIGENT, HOMELESS AND LEVIED BY THE IRS FOR $539,754 IN TAXES OWED FOR $2,088,554 IN CAPITAL GAINS MOURAD NEVER RECEIVED FOR THE YEAR 1997, AND $536,000 MOURAD NEVER RECEIVED FOR THE YEAR 1999, ALPHONSE MOURAD'S PETITION/MOTION TO REOPEN AND RECONSIDER THE PANEL'S OCTOBER 20, 2004 DECISION BASED UPON MISREPRESENTATIONS AND FRAUDULENT STATEMENTS MADE BY THE I.R.S. ATTORNEY AT THE SEPTEMBER 16, 2004 ARGUMENT, THE COURT'S OWN FAILURE TO 'LOOK AT THE RECORD,' AND THE COURT'S MISSTATEMENT OF THE FACTS AND MISAPPLICATION OF THE LAW ON WHO OWNED THE PROPERTY FOR PURPOSES OF OBTAINING THE LOW INCOME TAX CREDIT

THE PANEL OF THREE JUDGES DENIED ALPHONSE MOURAD'S MOTION ON AUGUST 10, 2005 FOR RECONSIDERATION AND COVER UP TO PROTECT I.R.S ATTORNEY, TERESA McLAUGHLIN'S FRADUAL STATEMENTS

These fraudulent statements cost Mourad $12,000,000 in tax credits that should have been awarded to him, as well as $2, 624,554 in capital gains he never received either. As a result, the IRS levied Mourad for a total of $539,754 in taxes on income Mourad never received.

Oral Arguments before the US Court of Appeals For the First Circuit, 9-16-04. The IRS attorney made fraudulent statements to the three Judges. One of them was that Beacon Residential Properties applied for the $12,000,000 tax credit in 1998, when in fact, Trustee Stephen Gray, who was appointed the owner of V&M Management by Judge Carol J. Kenner, applied for the tax credit and was approved for it in 1997.

This case has the potential to expose the fraud and corruption that has taken place with regards to tax credits issued by the IRS, partnered with the other governmental entities, nationwide. This case will demonstrate how the 1,500 minority (Black and Hispanic) Mandela residents were also victims, in that they were robbed of the home ownership that was promised to them by the U.S. Bankruptcy Court (Judge Carol J. Kenner), Trustee Stephen S. Gray, and HowardCohen, Mark S. Leventhal, and Norman B. Leventhal of Beacon Residential Properties. For more detailed information, click the "Beacon General Partners" button on the home page, and then click the sub-button called "Mandela Residents."

Further, the same panel (Judge Torruella, Circuit Judge; Judge Lynch, Circuit Judge; and Judge Coffin, Senior Circuit Judge) were familiar with the background and the complaint of Alphonse Mourad against Chief Judge of the United States Bankruptcy Court, Carol J. Kenner to the Judicial Council of the First Circuit. For further information, please click on "Corrupt Judges (Home Page)," and subuttons "Judge Torruella" & "Judge Lynch."

Please click on the main button "IRS Tax Scandal," then refer to subuttons "Motion Exposing Fraud," & "Exhibit to Fraud Motion." After reviewing the Motions and Exhibits, you can then decide for yourself whether or not said Judges covered up for I.R.S. Attorney, Teresa McLaughlin's misrepresentation of the facts of ownership of the Mandela and V&M Management, Inc., property at the September 16, 2004 oral argument, and the Court itself failed to look out the record, Tr. p. 23, line 21; thus leading to the Court's incorrect application of the facts and the law, resulting in the Court's incorrect and unjust decision.

United States Court of Appeals

For the First Circuit

No. 03-2367

ALPHONSE MOURAD,

Petitioner, Appellant,

v.

COMMISSIONER OF INTERNAL REVENUE,

Respondent, Appellee

INDIGENT, HOMELESS AND LEVIED BY THE IRS FOR $539,754 IN TAXES OWED FOR $2,088,554 IN CAPITAL GAINS MOURAD NEVER RECEIVED FOR THE YEAR 1997, AND $536,000 MOURAD NEVER RECEIVED FOR THE YEAR 1999, ALPHONSE MOURAD'S PETITION/MOTION TO REOPEN AND RECONSIDER THE PANEL'S OCTOBER 20, 2004 DECISION BASED UPON MISREPRESENTATIONS AND FRAUDULENT STATEMENTS MADE BY THE I.R.S. ATTORNEY AT THE SEPTEMBER 16, 2004 ARGUMENT, THE COURT'S OWN FAILURE TO 'LOOK AT THE RECORD,' AND THE COURT'S MISSTATEMENT OF THE FACTS AND MISAPPLICATION OF THE LAW ON WHO OWNED THE PROPERTY FOR PURPOSES OF OBTAINING THE LOW INCOME TAX CREDIT

The Appellant, Alphonse Mourad, respectfully moves and petitions this three judge panel (Coffin, Torruella and Lynch) to reopen and reconsider the Court's October 20, 2004 decision on the grounds that the I.R.S. Attorney, Teresa McLaughlin, misrepresented the facts of ownership of the Mandela and V&M Management, Inc., property at the September 16, 2004 argument, and the Court itself failed to "look out the record," Tr. p. 23, line 21; thus leading to the Court's incorrect application of the facts and the law, resulting in the Court's incorrect and unjust decision. Because of his indigency and pro se status, Mourad seeks leave to file only four copies of his Petition and accompanying attachments.

In support, Alphonse Mourad says and verifies as follows:

1. On September 16, 2004, a three judge panel of this Court (Torruella, Coffin and Lynch) heard oral arguments in Mourad's appeal of the U.S. Tax Court's decision finding Mourad personally liable for over $200,000 in assessed taxes stemming from the sale of assets of Mourad's bankrupt S Chapter corporation, V&M Management, Inc. V&M Management, Inc. filed for Chapter 11 Bankruptcy protection in January 1996; a Trustee was appointed in April 1996 and the Trustee, on December 18, 1997, "sold" V&M's assets - a 276 unit apartment complex in Roxbury known as the Mandela Apartments for $2.8 million as part of a September 26, 1997 confirmed bankruptcy reorganization plan developed by the Court appointed Bankruptcy Trustee, Stephen Gray.

2. Even though Mourad was represented by counsel at the September 20, 2004 argument, after this Court rendered its ruling on October 20, 2004, Mourad v. Commissioner of Internal Revenue, 387 F.2d 27 (1st Cir. 2004), Mourad, pro se, moved for an enlargement of time to petition for panel rehearing on the grounds that his attorney had withdrawn. The Court denied Mourad's Motion for an extension on December 9, 2004.

3. Alphonse Mourad has now had a chance to have the September 20, 2004 argument transcribed, and he brings this Motion to Reopen, because the transcript reveals serious misrepresentations by the IRS attorney and the Court's own failure to "look at the record," as the Court promised to do, Transcript, p. 23, line 21. Had the Court "looked at the record," the Court would not have ruled the way it did. The reason for reopening the appeal is to correct the Court's manifest errors; to avoid the "injustice" and acknowledged "unfairness .. to assess tax liability on shareholders who do not receive the income on which they are obligated to pay the tax," Mourad v. Commissioner of Internal Revenue, supra at 31; to correct the erroneous facts as to ownership of the Roxbury property upon which this Panel based its decision; and to clarify the correct status of the low income housing tax credits and Alphonse Mourad's entitlement to share in the sold proceeds of those credits.

In further support, Alphonse Mourad adds as follows:

4. In 1984, Alphonse Mourad became the sole shareholder of V&M Management, Inc. - owning 100% of the stock in that Chapter S corporation. At that time, V&M Management, Inc. operated 276 units of Sec. 8 housing in lower Roxbury, MA. In 1987, V&M Management, Inc. renamed the apartment complex after the imprisoned Nelson Mandela to support his freedom, and the complex became known as the Mandela Apartments. V&M Management, Inc. ran a series of programs, medical, social, and athletic, to empower the young African-American community that resided in the complex.

5. For the twelve year period, 1984 to 1995, that V&M Management, Inc., owned by its sole shareholder, Alphonse Mourad, ran the complex, Mourad refinanced and personally guaranteed the various loans that V&M Management, Inc. and Mourad had to take out to keep the complex financially afloat, with Mourad's goal of turning the development over to tenant ownership.

6. Having owned the property for ten, uninterrupted years and having satisfied the requirement for applying for a low income tax credit under 26 U.S.C. § 42, V&M Management, Inc. was prepared to apply for the low income housing tax credit.

7. Financial, property tax issues and an impending foreclosure of a third mortgage, securing a fraudulent note, prompted V&M Management, Inc. to file for bankruptcy protection in January 1996.

8. Upon the Joint Motion of the B.R.A., City of Boston and D.O.R., the Bankruptcy Court, (Kenner, J.), however, appointed Stephen Gray as Trustee of V&M Management, Inc. on April 2, 1996, and deprived V&M Management, Inc. of its opportunity to reorganize and refinance its debt, with its considerable, and valuable Roxbury property base, to remove Mourad and deprive Mourad of his property, as Mourad had became a pain to the powerful political forces in the City of Boston and State.

9. As Trustee, Stephen Gray stepped into the shoes of V&M Management, Inc.

10. After a year and a half of contested bankruptcy proceedings, the Court (Kenner, J.) held a hearing on September 26, 1997 on the competing reorganization plans and approved a final reorganization plan promoted by Trustee Gray and Beacon Residential Property that September 26, 1997.

11. Just prior to the Court's approval of Trustee Gray's backed plan, Trustee Gray applied for the low income housing tax credit. Gray's August 26, 1997 letter and One-Step Application was Exhibit 8-J as a part of the Tax Court record and the record appendix on this appeal, and incorporated herein. A September 9, 1997 letter by the Beacon Companies also referenced this August 1997 application for the $1 million in low income housing tax credits, attached hereto.

12. At the September 26, 1997 hearing on the reorganization plans, Trustee Gray's Attorney, Paul Moore, reminded the Court that Ms. Gumble, the Director of the Department of Housing and Community Development, testified that a "owner has site control" and that as Trustee, Gray has "legal title to the property," Transcript, at 73.

13. The Court (Kenner, J) reiterated that "Mr. Gray is V&M Management. He is the Chapter 11 Trustee duly authorized. No one but Mr. Gray can speak for the debtor at this point and the debtor owns the real estate," Transcript, p. 73.

14. Attorney Ricotta then reminded the Court that "Mr. Gray was a co-applicant on the tax credit application," Transcript, p. 73-74.

15. The Court (Kenner, J.) found that Trustee Gray "has site control as an owner. He is the owner in his capacity as Trustee of the debtor," Transcript, p. 77.

16. Having found Trustee Gray as the site-control owner, the Court then confirmed the Trustee Gray's supported plan to sell the property to Beacon Residential Properties Limited Partnership, based upon the Trustee's site control ownership and August 1997 application for the tax credits on behalf of the debtor, V&M Management, Inc. The first $1 million in tax credits was approved in 1997, not 1998, as this Court mistakenly says, at 31.

17. The reorganization plan having been confirmed on September 26, 1997, the tax credits had to have been approved in 1997, to secure the funds for the three consecutive years (1997, 1998, 1999) installments of payments to the debtor's (V&M's) creditors.

18. Had the tax credit not been approved in 1997, with Stephen Gray as the Court appointed Trustee and site-control owner, Stephen Grey could not have deeded the property to Mandela Homes Limited Partnership and Beacon Residential Property Limited Partnership on December 18, 1997, Tax Court, Exh. 9-J.

19. Under the low income tax credit statute, 26 U.S.C. § 42 (d)(2)(B)(ii), the applicant must have ten years of uninterrupted ownership of the property to qualify for the tax credits. This is confirmed by the Commissioner's May 2, 2002 Tax Court Trial Memorandum at pg. 4. Obviously, Trustee Gray, appointed only on April 2, 1996, did not own the property for ten uninterrupted years to qualify for the tax credits.

20. Gray's ownership was less than two years, and the tax credits granted to the new owners are invalid or fraudulent. Or, if V&M Management, Inc. did not qualify for the tax credits or apply for same, then Trustee Gray's standing in V&M's shoes could not have qualified for the tax credits either. But, in fact, only V&M Management, Inc. did qualify as the only ten-year owner of the property. Without Alphonse Mourad's participation or joiner in the application for the tax credits to take advantage of Mourad's twelve years of uninterrupted ownership, to qualify for the tax credits, there are no valid tax credits.

21. On the other hand, if Trustee Gray, standing in the shoes of the debtor V&M Management, Inc., by virtue of his April 2, 1996 appointment, also became the "owner" of the debtor's property, as the Bankruptcy Court (Kenner, J.) so ruled at the reorganization hearing on September 26, 1997, then Mourad no longer "owned" the property and no longer could be assessed for taxes on property he no longer owned or had not owned since Trustee Gray stepped into V&M Management's shoes on April 2, 1996.

22. Trustee Gray cannot step into V&M Management's shoes on April 2, 1996, run and operate V&M Management, Inc., collect all the rents and pay all (or some of) the bills and distribute no income to the former sole shareholder, Alphonse Mourad, and then expect that tax to be passed through to Mourad personally.

23. In the Court's earlier February 24, 2003 decision, In Re: V&M Management, Inc., 321 F.3d 6 (1st Cir. 2003), this Court, with Judge Torruella sitting on that panel, affirmed the Bankruptcy Court's ruling that Mourad lacked standing and lacked an equity interest in the debtor to pursue his claims against the Trustee and debtor's prior counsel. This Court's February 24, 2003 ruling that Mourad lacked standing or an equity interest is totally inconsistent with the Court's October 20, 2004 ruling that Mourad was still the sole shareholder of V&M Management, Inc. for purposes of being assessed taxes on Chapter S passed through income and gains that Mourad never received. That is, Mourad v. C.I.R., supra contradicts In re: V&M Mangement, Inc., supra, and vice versa. This Court cannot have it both ways. Either Alphonse Mourad is an owner or holder of an equity interest, or Alphonse Mourad is not. Judge Torruella sat on both Panels and he should have been familiar with the February 24, 2003 decision. Under this Court's October 20, 2004 Ruling that Mourad is the Chapter S Taxable Taxpayer, that is a sufficient interest to give Mourad standing to pursue his legitimate claims against Trustee Gray and Hanify & King, that this Court, on February 24, 2003 denied, without hearing or oral argument, as the case was "Submitted."

24. It is illogical, unfair and a misapplication of the tax code to assess taxes against a sole shareholder of a bankrupt Chapter S corporation, when the shareholder of the debtor is not the site owner or operator of the property (Trustee Gray was), or the person deeding the property to the new owners (Trustee Gray was). Only the true owner can execute a valid deed and convey the property to the new buyers. That was Trustee Gray, not Alphonse Mourad. Gray, as Trustee, should have been assessed the taxes and not Mourad, as Gray sold the bankrupt V&M Management, Inc. estate, deeded the property and secured the tax credits for the debtor's creditors. Mourad got nothing. How, then, is it possible that Mourad is saddled with the substantial taxes- $539,754, on $2,625,485 in profits Mourad did not receive. The IRS Code may have its oddities, quirks, and irrationalities, but it cannot be this odd, quirky or irrational. This Court cannot allow such an absurd or perverse result to stand.

25. If Mourad is personally liable for the taxes, (on unreceived capital gains), then he is entitled to the tax credits. Trustee Gray and Beacon Residential Properties cannot validly take advantage of the tax credits, as neither owned the property for the requisite, statutory, uninterrupted ten years, and cannot take the proceeds of the sale of those credits and pass through the taxes to Mourad, simply because the shareholder and S corporation are separate tax entities. Once the Bankruptcy Court appointed Gray as Trustee, he stood in V&M Management's shoes and become the owner/operator site controller of the property. Mourad, as the sole shareholder, lost his equity and standing. If Mourad had no standing or equity -- findings/rulings affirmed by this Court on February 24, 2003, In re: V&M Management, Inc., 321 F3d 6 (1st Cir. 2003), then Mourad cannot be assessed taxes on property he no longer owned, operated, controlled or had an equitable interest in, and this Panel's decision in Mourad v. Commissioner of Internal Revenue, 387 F.3d 27 (1st cir. 2004) is wrong, but correctible.

26. In her argument to the panel, IRS Attorney McLaughlin stated that the buyers of the complex applied for the housing tax credits and obtained them for the 1998 tax year, and that V&M Management, Inc. never applied. Ms. McLaughlin then furthers her misrepresentations when she says that "nobody for the tax year 1997 ever applied to the state and the application was granted for the year 1998, when V&M Corporation didn't own the complex," Transcript, at 20.

27. The Court then agrees, adding "Right, right, right .. there's a mismatch in time," Transcript, P. 20, lines 22-23.

28. This is wrong. Trustee Gray was a "co-applicant" for the tax credits in 1997. See his August 26, 1997 letter, Exh. 8-J and the September 26, 1997 confirmed this hearing Transcript, pp. 73-74. That 1997 application was approved in 1997, or else the September 26, 1997 confirmed plan and December 18, 1997 Trustee Gray executed deed would not have transferred the property/assets, including the tax credits, in 1997.

29. The Bankruptcy Court found Trustee Gray as the "site control/owner," Transcript, at 77.

30. Having had all its assets sold under the September 26, 1997 confirmed plan, on December 18, 1997, the April 2, 1996 appointed Trustee Gray did not pay any state corporation fees and V&M Management, Inc. was dissolved on August 31, 1998, Ex. 21-J.

31. Dissolved on August 31, 1998, the dissolved V&M Management, Inc. would not be entitled to any 1998 tax credits, thus supporting the view that the tax credits were approved and obtained and used in 1997 - not the 1998 year of V&M's dissolution, as this Court erroneously says, at 31.

32. The Panel says that Mourad took no steps to terminate V&M Management's S corporation status, at 30-31. The reason for not electing to terminate its Chapter S status is that Mourad was not in control of V&M Management, Inc., to terminate its tax status, since Trustee Gray was the only "person to speak for V&M Management," as the Bankruptcy Court (Kenner, J.) put it on September 26, 1997, Transcript, p. 73.

33. But if Mourad were in control, there were good reasons not to terminate V&M Management, Inc.'s S Chapter status, and that was V&M Management, Inc.'s ability to apply for and obtain $12 million in tax credits -- an asset to the S corporation that had owned the property for over ten uninterrupted years, and the only entity statutorily eligible for the credits.

34. The real issue here is what happened to the profit on the sale.

35. How could an S corporation generate, in 1999, another $536,000, when the property was sold on December 18, 1997, and that V&M Management dissolved on August 31, 1998. Where did the $536,000 come from.

36. This Panel said it would "look into the record," Transcript of Oral Argument, p. 23. The Court did not. Had the Court carefully examined the record, as the Court is obligated to do in bankruptcy cases, the Court would not have rendered the October 20, 2004 decision it made.

WHEREFORE, Alphonse Mourad respectfully requests the Panel to reconsider the Panel's October 20, 2004 decision, to cancel Mourad's tax liability, to restore to Mourad the low income tax credit, as neither Trustee Gray nor Beacon Residential Properties are statutorily entitled to it, and to order the IRS to not recognize the fraudulent and statutorily invalid tax credits, unless Alphonse Mourad's is made a partner with Beacon Residential Properties and he receives his just due and deserts.

Alphonse Mourad refuses to be a victim of the political and legal forces that have come to bear and that have deprived him of his twelve year investment in the Mandela property, with nothing to show for it but impossible to pay tax liabilities and life-time tax liens, destroying his ability to ever own property and do business again.

July 13, 2005

Alphonse Mourad

P.O. Box 882

Watertown, MA 02471

(617) 458-1835

(Temporary Cell Phone)

CERTIFICATE OF SERVICE

I, Alphonse Mourad, hereby certify that I have hand-delivered four copies of the Motion to Reopen and Attachments upon the Clerk, 1st Circuit Court of Appeals, Oakley U.S. Courthouse, One Courthouse Way, Boston, MA 02210, and that I mailed one copy upon Teresa E. McLaughlin, Tax Division, U.S Dept. of Justice, P.O. Box 502, Washington, D.C., 20044 on this July 13th, 2005.

Cc: www.bostonmandelascandal.com

Alphonse Mourad

United States Court of Appeals

For the First Circuit

____________________

No. 03-2367

ALPHONSE MOURAD,

Petitioner, Appellant,

v.

COMMISSIONER OF INTERNAL REVENUE,

Respondent, Appellee

MOURAD'S ATTACHMENTS TO HIS MOTION TO REOPEN

1. Mourad v. C.I.R., 387 F.3d 27 (1st Cir. 2004)

2. September 16, 2004 Transcript of Oral Argument

3. Mourad's Motion to Enlarge Time

4. December 9, 2004 Denial of Motion for Extension

5. August 26, 1997 letter re One Step Application for low income tax credits

6. September 9, 1997 letter by Beacon Companies

7. September 26, 1997 Transcript of Bankruptcy Court Confirmation Hearing, pp. 73-77

8. May 2, 2002 Commissioner of I.R.S. Tax Court Memorandum.

9. December 18, 1997 Deed, Trustee Gray to Mandela Homes and Beacon Residential Properties

10. In re V&M Management, Inc. Debtor, 321 F.3d 6 (1st Cir. 2003)

11. Secretary of the Commonwealth Statement of 8/31/98 Dissolution of V&M Management, Inc.

12. 1999 K-1 Profit loss Statement signed by Stephen Gray

13. Findings for landlord in Granola Highland v. Evicted Tenant, Alphonse Mourad, Malden District Court, C.A. No. 05-50-SU-123, (March 24, 2005)

14. IRS Tax Lien Levies

1997 $335,290.70

1997 $204,463.66

$539,754.36

PLEASE CLICK THIS LINK TO REFER TO EXHIBITS TO FRAUD MOTION.

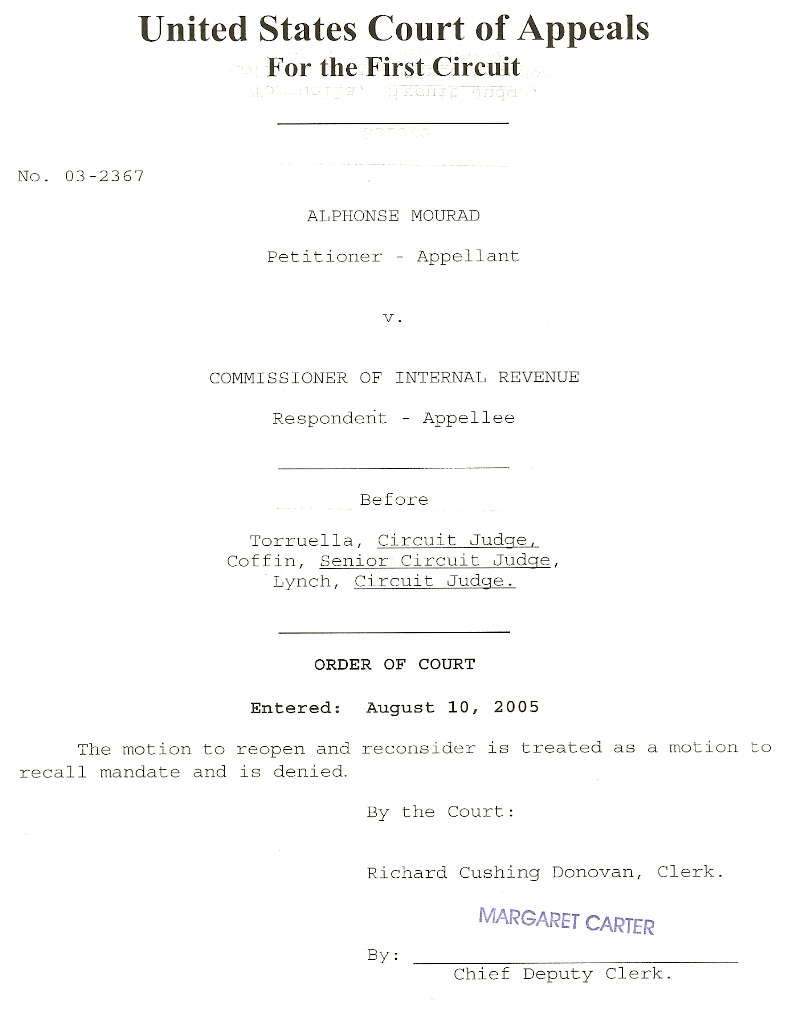

Above is the Order submitted by Judges Torruella, Lynch and Coffin, denying Mourad's Motion to Reopen and Reconsider. They didn't even write a Memorandum explaining why the Motion was denied. Is this justice? Click on the Order above to link to the original Motion that was filed. Also, for further information on Judge Torruella and Judge Lynch, click on their pictures on the main Home page.

Internal Revenue Service Tax Credit Scandal:

INDIGENT, HOMELESS AND LEVIED BY THE IRS FOR $539,754 IN TAXES OWED FOR $2,088,554 IN CAPITAL GAINS MOURAD NEVER RECEIVED FOR THE YEAR 1997, AND $536,000 MOURAD NEVER RECEIVED FOR THE YEAR 1999, ALPHONSE MOURAD'S PETITION/MOTION TO REOPEN AND RECONSIDER THE PANEL'S OCTOBER 20, 2004 DECISION BASED UPON MISREPRESENTATIONS AND FRAUDULENT STATEMENTS MADE BY THE I.R.S. ATTORNEY AT THE SEPTEMBER 16, 2004 ARGUMENT, THE COURT'S OWN FAILURE TO 'LOOK AT THE RECORD,' AND THE COURT'S MISSTATEMENT OF THE FACTS AND MISAPPLICATION OF THE LAW ON WHO OWNED THE PROPERTY FOR PURPOSES OF OBTAINING THE LOW INCOME TAX CREDIT.

This case has the potential to expose the fraud and corruption that has taken place with regards to tax credits issued by the IRS, partnered with the other governmental entities, nationwide. This case will demonstrate how the 1,500 minority (Black and Hispanic) Mandela residents were also victims, in that they were robbed of the home ownership that was promised to them by the U.S. Bankruptcy Court (Judge Carol J. Kenner), Trustee Stephen S. Gray, and Howard Earl Cohen, Mark S. Leventhal, and Norman B. Leventhal of Beacon Residential Properties. For more detailed information, click the "Beacon General Partners" button on the home page, and then click the sub-button called "Mandela Residents."

Oral Arguments before the US Court of Appeals For the First Circuit, 9-16-04. The IRS attorney made fraudulent statements to the three Judges. One of them was that Beacon Residential Properties applied for the $12,000,000 tax credit in 1998, when in fact, Trustee Stephen Gray, who was appointed the owner of V&M Management by Judge Carol J. Kenner, applied for the tax credit and was approved for it in 1997. (MP3)